9 April 2023

Next Wave: Crypto’s quick-money promise for Africa is collapsing

Photo Abraham Augustine via Midjourney. See "alt" for prompt

Despite what was advertised, the unspoken (in public ads and Twitter) case for crypto in Africa, was to get rich—and quick. Recent events are showing the cracks and will hopefully introduce some humility.

In the last three years, Africa has developed its class of crypto preachers who have joined the global refrain to sing the praises of blockchain money. Since Bankman-Fried’s Icarus Act, the trajectory of the crypto moon ride globally has inverted. And even in Africa, the love affair with crypto was mostly a ZIRP (zero-interest-rate phenomenon). That does not mean that the camel’s back has been broken yet. It just means that it's a lot easier to call BS. Farcical crypto stories now fail to take in many of the formerly credulous. Except for the ultra-hooked.

“Many Africans have integrated crypto into everyday life,” reported the crypto-focused publication, CoinDesk in 2022. Coindesk’s source was a report published by Chainalysis, the crypto research firm. The report claimed that $100.6 billion in transactions were recorded on-chain between July 2021 and June 2022. According to Chainalysis, “Crypto usage is driven by everyday necessity, as opposed to speculation by the already well-off … especially in countries where the values of local fiat currencies are dropping, as we’ve seen in Nigeria and Kenya.” Any African can tell you that this is patently not true.

Crypto in Africa was supposed to have stronger use cases. Bitcoin could hedge against punishing and unyielding inflation in Africa. Crypto would protect users’ wealth as the value of currencies dropped. But more importantly, Africans could now “participate in the global economy” by trading all sorts of crypto derivatives and products. If you were enterprising enough—like the gentlemen who founded Wakanda Inu—you could even create and sell your tokens. Wakanda Inu, Africa’s “answer” to the popular meme token, Shiba Inu, has gone the way of all pyramid schemes, which is to say, the toilet.

Instead, Africa’s crypto path has been riddled with blundering regulation, an abundance of grift, scams and the like. And plenty of condescension from larger global crypto exchanges and figureheads, who talk fondly, almost paternally about the “global south” need of crypto while routinely offering poor service to African crypto users or outright denying them service. The result is predictable. More scams and grifts.

I remember sitting at a coffee shop two years ago, and discovering over a casual chat with my neighbour that she was in the early stages of creating a new token and she tried to recruit me. I joined her “project’s” Telegram group to witness first-hand the makings of a crypto “project”. Needless to say, her project, I forget the name now, failed to take off, despite vigorous campaigning by her and her foreign and local partners.

Several popular peer-to-peer crypto marketplaces' have shut-down operations recently. | Infographic: Ayomide Agbaje — TechCabal Insights

Far from being a simple store of value or a hedge against inflation and currency depreciation, cryptocurrencies fuelled an epidemic of speculation in Africa. WhatsApp groups burst at the seams as young Africans piled on, hoping to get trade “signals” to guide their margin trades. And prophets predicted trade swings on social media. Outside the stablecoin model, the cryptocurrency craze in Africa, like its cousins anywhere else on earth, was built on zero utility and plenty of hopium. It made a few rich and popular. But it did not do much else. Even though for some reason, CNBC thinks Bitcoin will, “blow up Africa’s $86 billion banking system.”

Instead, in the last six months, the lack of cheap money occasioned by rate increases from central banks is forcing the cracks in crypto’s carefully designed exterior to crack. After FTX, which had a large ground game in Africa, complete with university ambassadors and a rural outreach programme, collapsed, three other Africa-focused crypto exchanges have shut down recently, including Localcryptos, Localbitcoins and most recently, Paxful.

Partner Content: Google Workspace subscriptions are increasing but FOUND NG is making access cheaper for Nigerians

Another one bites the dust

When Paxful announced it was shutting down last week, 46-year-old Ray Youssef, who served as founder and CEO, blamed “key staff departures” and “regulatory challenges” for the decision. What he did not say was that issues with his co-founder, Artur Schaback, had gotten to a head. Schaback had sued his partner and co-founder in January this year for, among other things, “an illegal plan to avoid international sanctions on transactions into and out of Russia”. Other details of Paxful’s sordid backyard are contained in this CoinDesk report. But it is instructive to note that until the sudden announcement of the exchange’s closure, Youssef gave no indication of trouble, as he put out Bitcoin platitude after platitude sprinkled with political tweets, mostly aligning with one of Nigeria’s presidential candidates, Peter Obi. A substantial portion of Obi’s supporters is predominantly young dwellers in cities—the same demographic of users targeted by Paxful and other crypto services.

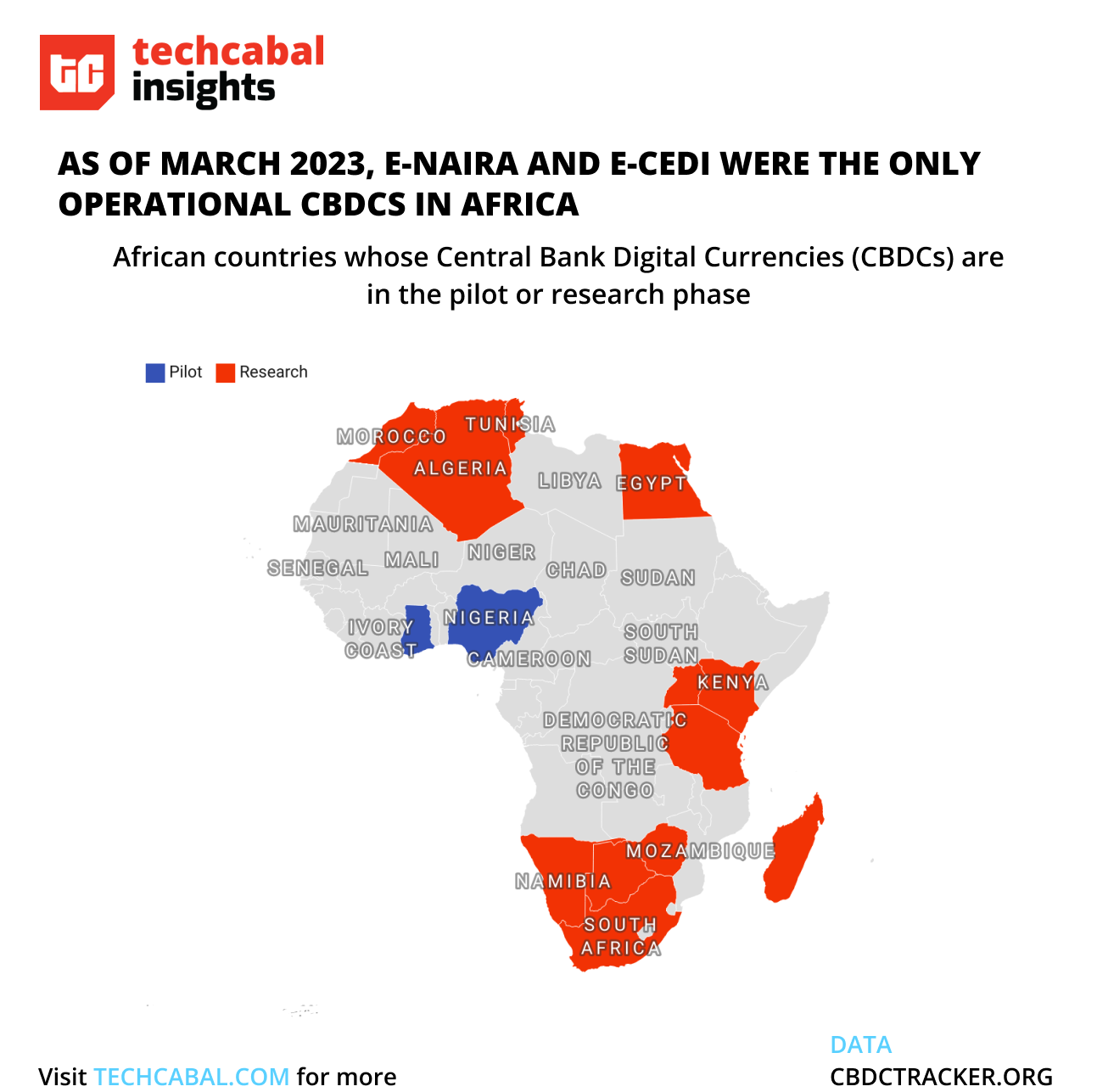

Several African countries are exploring the use of central bank digital currencies to enhance payment systems. | Map: Ayomide Agbaje — TechCabal Insights

One can argue that one of the most significant impact of cryptocurrencies—globally—is the acceleration of retail central bank digital money a.k.a CBDCs. Indeed the excesses of the crypto-verse plus the growing desire of governments to control every inch of how their respective governed masses live is part of the motive behind (and justification of) CBDCs. “. If you want to use digital assets, use eNaira. It has all the properties of a digital asset,” one central bank official quipped in Nigeria.

Like FTX, the sudden shutdown of Paxful, which was closer to its users in Nigeria and Kenya, may force crypto users in Africa to second-guess their investments. Or it may not (for the most committed or most grifting). What is important is that it is one less blocker in the conversation about how absurd the story of crypto in Africa has been sold. It may make it easier to call out the outright rackets that have never been called out.

That’s me being hopeful. If the crypto group I am in is any indication, the addiction to fixes from crypto wins grift is still too strong.

We'd love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Reporter, Business and Insights

TechCabal.