07 January, 2024

Should Nigeria's startups consider listing on its stock exchange?

A group photograph at the Nigerian Stock Exchange trading floor

The Nigerian Stock Market has overperformed its target since 2020 till date. Nigerian startups can take advantage of last year’s bull run to list on the Nigerian Tech Board in 2024.

Ever since the Nigerian Stock Exchange Group (NGX) secured regulatory approval for the NGX tech board from Nigeria's Securities and Exchange Commission (SEC) in 2022, it has been very serious about getting tech startups in the country to list.

Temi Popoola, the new group managing director/CEO of the NGX, has been the key man in front of that campaign. At the end of 2023, Popoola was appointed group managing director/CEO, replacing a retiring Oscar Onyema , the former GMD of the demutualised Nigerian Stock Exchange Group (NGX). The rightness of this appointment may have been cemented by the moves Popoola made in 2023 while he was acting CEO.

Popoola's mission at the Nigerian bourse is driven primarily by two main goals. The first is to secure tech stocks on the NGX Tech Board, and the second is to open the market to institutional and retail investors.

Popoola came close to these goals in 2023, securing three listings last year—Mecure Industries; Nigeria Infrastructure Debt Fund (NIDF); and VFD Group, a Lagos-based investment firm. All three listings contributed about ₦179 billion to the exchange’s market cap in 2023. One of the three listings, VFD Group, represented a milestone because in 2021 it invested a total of $35.6 million into three firms , including Piggytech (Nigeria’s leading savings platform). Securing this listing means that 2024 could see more tech firms cosy up to the exchange.

A deadlock on first try

In a country that has produced over 400 tech startups, the NGX tech board is eyeing the likes of major players or tech unicorns like Jumia, OPay, Interswitch, Flutterwave and Andela to lead the way in listing on the stock exchange.

In September 2023, Popoola flew to New York to have a sit-down with Nigeria’s minister of communications, innovation and digital economy, Bosun Tijani; Flutterwave CEO, Olugbenga Agboola; and the CEO of Chapel Hill Denham, Bolaji Balogun to discuss the possibility of Flutterwave listing on the stock exchange. The meeting was not widely publicised, but there is a viewing link to it. Top of the agenda at that meeting was a plea made by Popoola to Flutterwave to list. He even offered a naira listing to get the tech firm to list. Flutterwave has yet to make any commitments to the bourse.

To list or not?

It is easy to get worried about the many things that could go wrong if a tech firm goes to the IPO market. Whether a listing happens on the NASDAQ or NGX, stock prices can tank. Jumia’s shares plummeted in 2019 and it is still chasing a comeback on the New York Stock Exchange (NYSE) to the initial price of $14.50 apiece it listed with. Egyptian-born and UAE-based mobility startup, Swvl, endured a similar rocky start when it listed on the NASDAQ; its stock price fell by 99% after listing at $9.95 per share. Its recent good fortunes have seen the stock price rebound to $3, after it posted its first profit in its H1 2023 results.

At the same time,tech firms are often eager to remain private companies, as it protects them from being publicly-listed and easily investigated.

But there is much to gain from listing on the Nigerian Tech Board.

Partner Content:

Web Summit Qatar is partnering with The FutureList to invite top African tech startups to exhibit in Doha in February 2024.

Read all about it here.

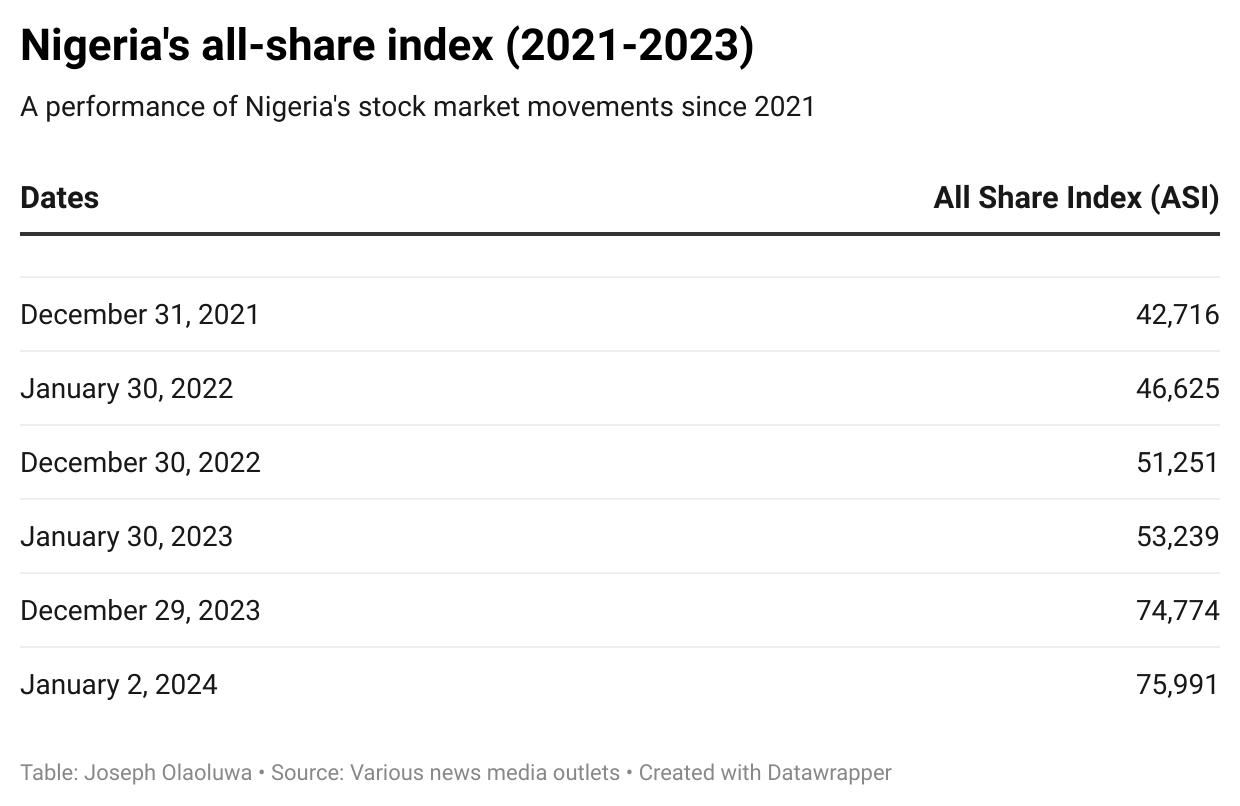

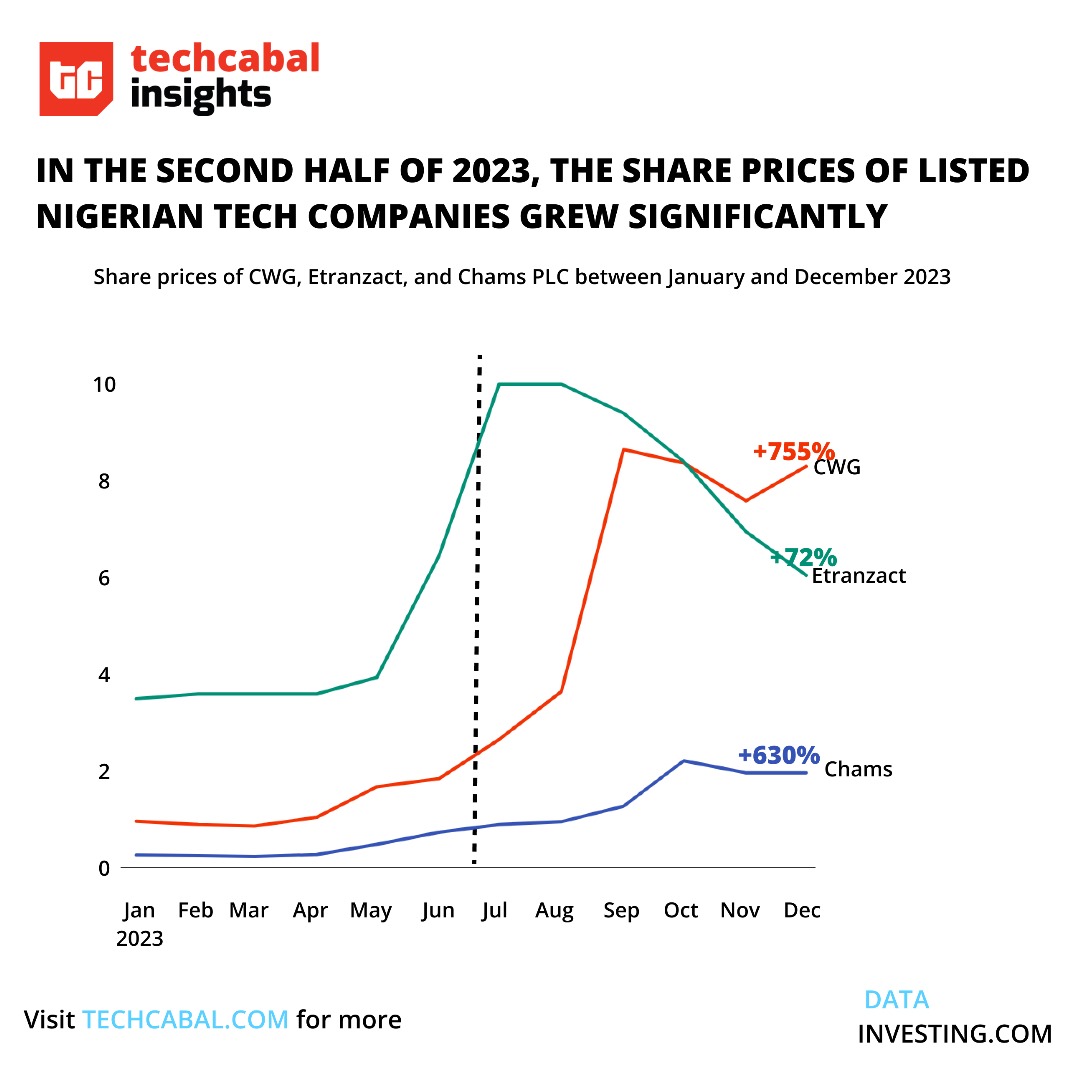

Since 2020, Nigerian equities have supercharged the investment ecosystem. In that same year, Bloomberg named the exchange as the best-performing stock market from 93 global indexes. The trend has continued upward since then. Publicly available data reported by TechCabal on Friday showed that the stock market has consecutively opened the New Year since 2021 on a high. All through last year, the Nigerian stock exchange recorded a 45.9% growth, driven by oil, gas, banking and tech stocks. Around September last year, popular conversations in private spaces were that if you put ₦1 million in any tech stock, you would get at least ₦5 million, if not more. Last year, the share prices of three publicly-listed Nigerian tech companies—Chams, eTranzact and CWG—were up over 700%, according to another TechCabal report. This new year week alone, the Nigerian stock market grew 6.54% to close at a new all-time high of 79,664.66 points.

Although the stock exchange experienced delistings last year, it still doesn't diminish all the positive evidence showing that a bull run has been on for the last three years; there will always be up and down times in the stock market.

Partner Content:

WeTech, the community for women in Nigeria's tech ecosystem hosted their first conference earlier this month. Here's what it was all about.

Since tech is often touted as the “new oil”, a listing by tech firms on the NGX Tech Board could be a win-win that many tech unicorns in Nigeria need. More importantly, with Popoola at the helm, there is renewed hope for the tech board which can bring more foreign, institutional, and retail participants to the market.

Joseph Olaoluwa,

Senior Reporter, TechCabal.

Feel free to email joseph.olaoluwa[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We'd love to hear from you

Psst! Down here!

Thanks for reading today's Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon - Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.