27 August 2023

The Ethiopian miracle has been waiting too long

A starry sky over Gambo Hospital, Ethiopia | Photo by Lucio Patone on Unsplash

Some housekeeping news here. From September, we'll be adding new voices to Next Wave as two of TechCabal's senior reporters, Joseph Olaoluwa and Kenn Abuya, join me on the Next Wave beat!

This is the last (for now) edition of our ecosystem reviews and was co-written with Kaleab Girma, of Shega.co, an Addis Ababa-based integrated media, data, and intelligence firm that focuses on the innovation, technology, and startup space in Ethiopia.

Now on to today's edition.

Ethiopia has always enchanted foreigners with its rich history and dated traditions. Some of them are preserved in the form of solid rock monoliths that defy explanation, given the crude tools of the era they were built. More recently, Ethiopia enchanted global emerging market watchers with its average GDP growth of more than 10% from the mid-2000s to the 2010s. This economic growth miracle dipped to 8% in 2015 and has since struggled to break 7% since 2019, around the same time that violent fraternal conflict drew storm clouds over economic reform and progress.

But investors, especially investors with geo-political interests, are not backing down. This historic nation of more than 120 million people and Africa’s 7th largest economy is far too important, especially in the face of a fracturing global order. This is despite lamentations from investors that Ethiopia is yet to shake off the remaining vestiges of its closed economy philosophy, they can’t seem to shake themselves away. Ethiopia is the one gem that, despite contradictions, global investors seem determined to have a foothold in.

Naturally, technology is not left out of this drama. In 2021, the battle was over a drawn-out bidding process for a second telecom licence which a US-led consortium won over a China-backed consortium. Here’s how The Africa Report described the aftermath of the bidding in June 2021.

“A new front” or even “a war of proximity” is taking place between Washington and Beijing, one that is creating “a new hitch” in the “deal of the century”. From the pages of the Wall Street Journal to the columns of the French press, the Ethiopian telecoms sector’s liberalisation—one of the most divisive battles within the industry in Africa over the past decade—has turned into a surprising ideological and geopolitical battle, open to the most varied interpretations.

For those not familiar with the story, the US International Development Finance Corporation (DFC) backed the Vodafone-Safaricom consortium with a $500 million loan that enabled it to offer $850 million to beat their rival bidder, South Africa’s MTN Group. MTN’s $600 million offer was backed by the Chinese Silk Road Fund, which is financed by the China Development Bank and Eximbank of China, among others.

Eventually, the DFC backed out of the Safaricom deal, but the deal was already done. And American money would still come in in another form. Earlier this year, the International Finance Corporation (IFC) joined the Safaricom-Vodacom consortium as a minority shareholder. To gain this privilege, the IFC paid $157.4 million for its equity position and put up an additional $100 million loan to Safaricom Telecommunications.

On the other side of the equation, Ethiopia has benefited heavily from Chinese investment in infrastructure, especially industrial and technology parks stretching back the last two decades. As you know, last week, the second-most-populated African country received an invitation to join the BRICS bloc of developing nations alongside Egypt.

Why is all of this important? Because technology, especially today (and in fact for all time), never exists in isolation from economic prospects and the resulting social and political consequences. And Ethiopia, with a mostly young population, is as good as any candidate for the combination of youth, economic reform and tech-assisted advances to unlock the Ethiopian miracle. This miracle is already in the early stages so I invited my friends from Shega, to help shed light on this. The next section is what Kaleab had to say.

A growth boom all round

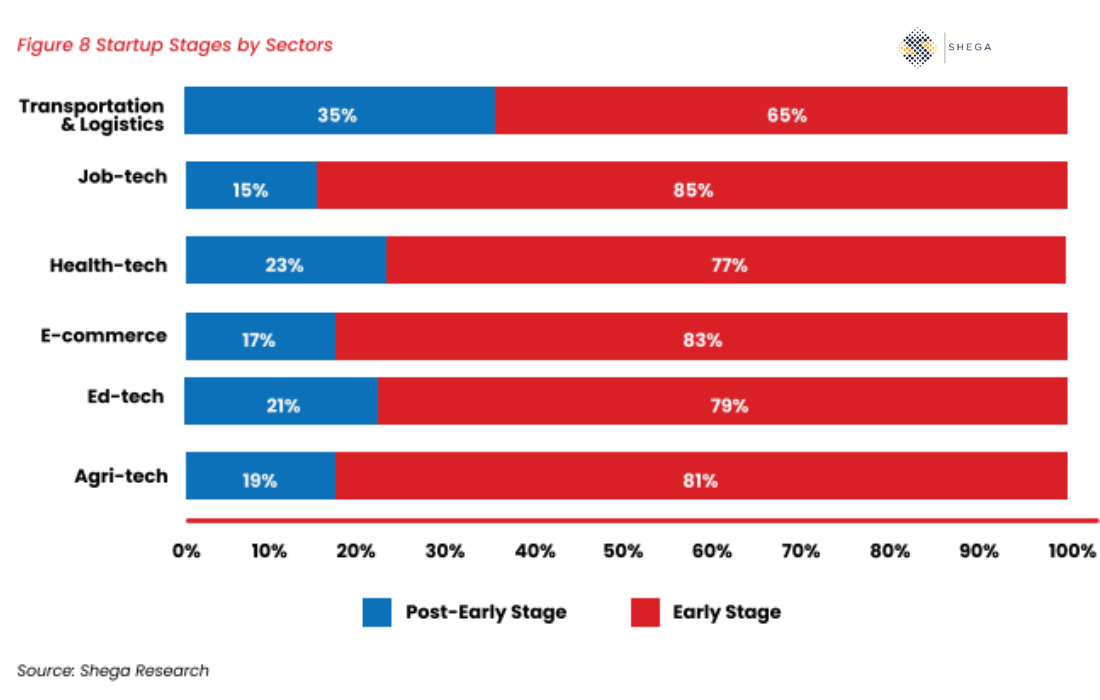

Early stage startups dominate the nascent ecosystem. Chart by Shega Research

Not too long ago, news about Ethiopian startups securing funding was a rare occurrence. Nowadays, these advancements grace media outlets and capture public attention with greater frequency. Venture capitalists are increasingly directing their focus towards Ethiopian startups, while Ethiopia is witnessing a rapidly growing pool of startups launching various digital services that dared to change the traditional ways of doing business.

Digitisation in Ethiopia is advancing at an accelerated pace. It stands as a national agenda supported by several international development organisations. With a vision to cultivate a digital economy, the Ethiopian government has enacted a comprehensive digital strategy known as "DIGITAL ETHIOPIA 2025". This strategic framework is designed to extend digital services to pivotal sectors like agriculture, manufacturing, and tourism, with a particular emphasis on empowering the private sector.

In addition, the country’s first National Digital Payments Strategy was passed in 2021 aiming to use digital financial services as a vehicle to enhance financial inclusivity.

Several person-to-government and person-to-business payments have been digitised, with citizens only being allowed to pay for certain services such as fuel using only digital platforms. The state contends that it is at the forefront of driving the adoption of digital platforms throughout Ethiopia.

In parallel, a massive liberalisation agenda is unfolding, including one that has seen a century-old state telecom monopoly come to an end. In the past three years, several home-grown fintech startups have also erupted making waves after working areas were freed for them simultaneously with changes. The likes of Chapa and Santimpay were able to process one billion birr (around $18 million) in transactions within a few months of launch.

Meanwhile, all of these advancements are taking place within a country boasting a substantial population of 120 million. The majority of this populace consists of young individuals who are receptive to technology and deeply engaged with the digital realm. Ethiopia presently holds a smartphone penetration rate of 42%, accounting for 34 million smartphone devices. While this statistic remains slightly beneath the sub-Saharan average of 49%, there has been a steady improvement over recent years.

Numerous innovators and industry observers hold the conviction that Ethiopia represents an untapped market primed to reward the next generation of innovators armed with the right products and ideas.

Distractions all around

As Kaleab pointed out in the section above, “untapped potential” is a fitting descriptor for where Ethiopia is from a digital economy standpoint and in general. The key reason for this is the many distractions, to put it lightly that the country has to contend with. Ethiopia is one of the most influential actors in the Horn of Africa region. And this region is a region of contrasts and age-old political intrigue. It is one of the more troubled parts of the African continent.

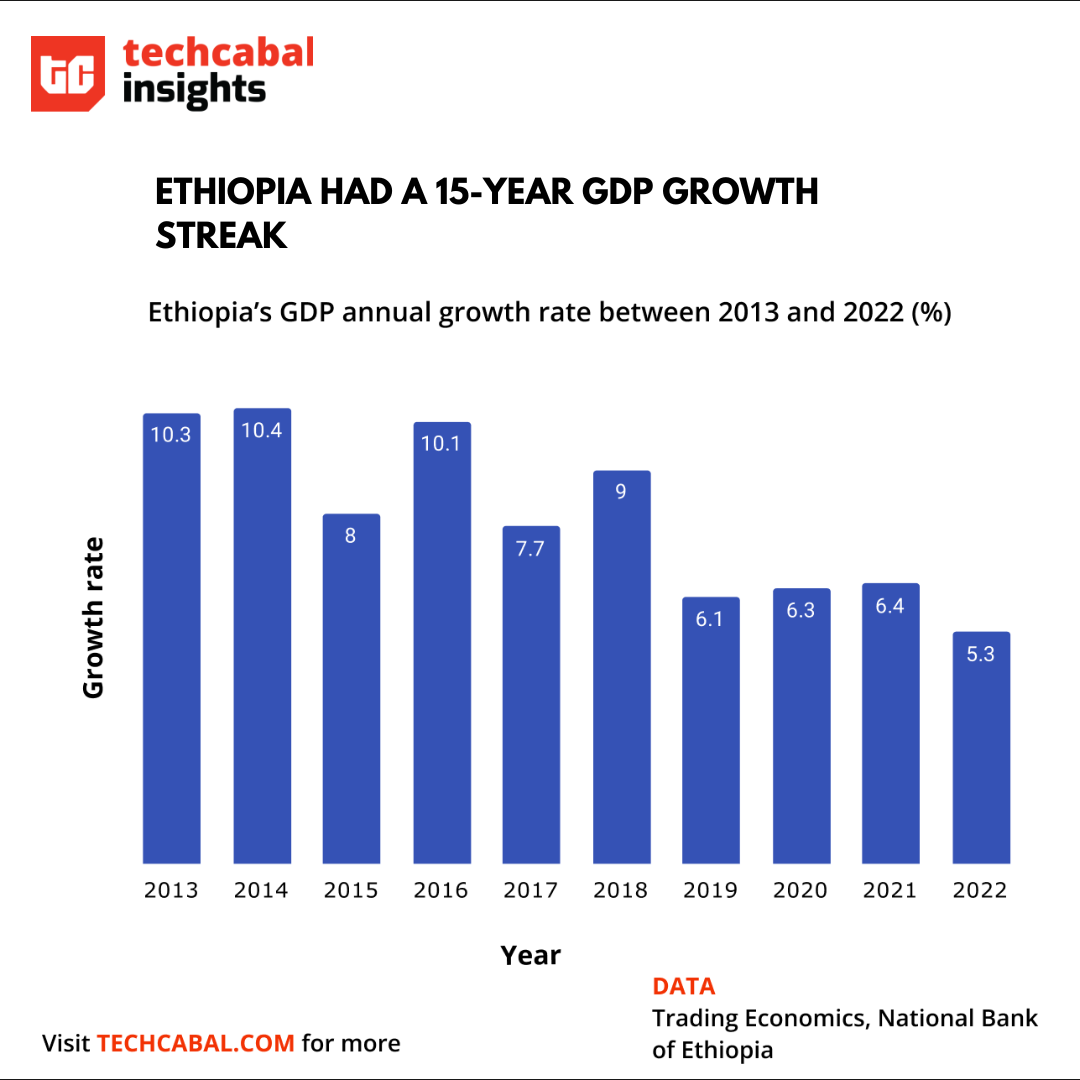

Economic growth has slowed but reforms continue albeit slowly | Chart by Ayomide Agbaje, TC Insights

The result of operating reform at home and abroad is mixed. Since 2019, Ethiopia’s 15-year 9.5% average GDP growth streak has hovered around 6% even dipping to 5.5% in 2022. Ironically, this slowdown came at the heights of an economic reform program that was first thrown in disarray thanks to COVID, and later the war in Tigray.

Despite these setbacks, it is notable that the government has been able to press on with some reforms, especially in opening up the telecom sector and making positive noises about opening up the banking and financial sectors as well. Some of these reforms have been at least partly driven by the need to shore up foreign exchange reserves, and I personally wonder about the extent to which these reforms would have been pursued if FX were of no concern. “Taken together,” I wrote last September, “the banking sector proposal and Safaricom’s trial show how much Ethiopia wants to unfurl the reform flag. What is not clear is if it will fly.”

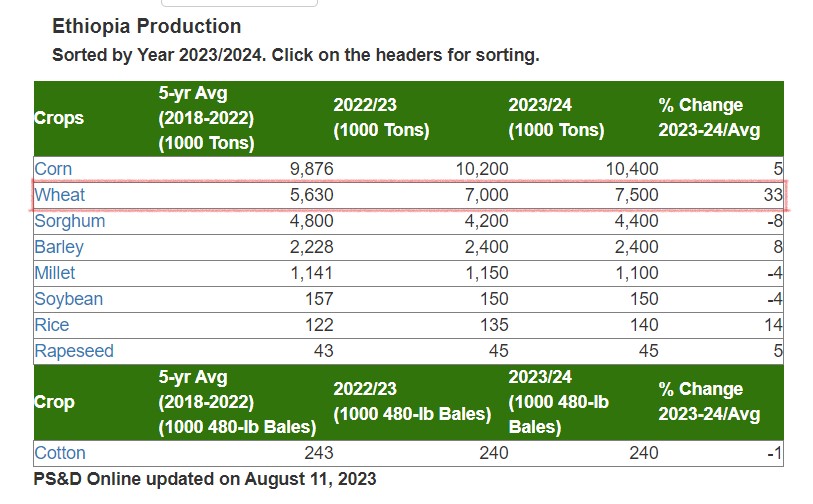

The country is a growing hotbed for STEM talent. It has a strong, educated and resourceful diaspora. The country’s bouts with drought-induced famine is far from over but agricultural reforms are beginning to yield fruit as agricultural productivity for key grain crops has increased to the extent that Ethiopia's government is positioning itself (in the media at least) to one day vie for the title of bread basket" of the region. (See chart below). Although the current bumper harvest is not enough to alleviate hunger from the millions dependent on food aid, it is important progress and the government is keen to point this out.

Ethiopia plans to begin grain exports on the back of a bumper harvest as agricultural reforms begin to take hold | Chart source: United States Department of Agriculture

But the reform agenda is still painfully slow.

Capital controls and onerous business practices still deter local and international investment and internal conflict is not far from the news. Safaricom Ethiopia has had to pause operations in some areas recently.

Ultimately, these distractions will need to be dealt with if Ethiopia’s digital sector will transition from simply creating early-stage startups to building the more mature business that capital allocators love. The same holds true for the rest of the economy. Many of the ingredients for the Ethiopian miracle already exist in some form, mostly raw. The processing power to turn potential energy kinetic is what is missing and not for lack of capable people who can make this happen.

We'd love to hear from you

Psst! Down here!

Thanks for reading today's Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon - Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Reporter, Business and Insights

TechCabal.